Today we’ll talk about step by step way to save for retirement. One of many ways to save for retirement of course. This blog post was written for the average person looking to save for retirement. However it doesn’t matter if you are an expert when it comes to investments, this will work for you too.

But we must address the elephant in the room first. Your credit card debt. Stop borrowing money from credit companies!!!! Some of us live paycheck to paycheck, which makes it harder to catch a brake. But I promise once you create a system, you’ll pay your debt off without even thinking about it. This will allow you to free up your time, you could create more income or simply spend more time with the family stress free.

(If you don’t have credit card debt, great skip ahead.)

If you have lots of debt, your first assignment is to find out exactly how much you owe and find out a payoff date. Most people don’t know who much they owe, which is a huge problem. First have a seat and call all your credit card companies and put the number on a piece of paper. Yes, write it down! Calculate the total amount you owe.

Next we’ll write down all our expenses including gas, rent and money to go out. It’s also important to take inventory of your subscriptions. Who are you subscribing to? You might think $1 here or $9 dollars there doesn’t hurt, until you see how much all of those dollars would be worth 20 years later with compounding interest.

But for now let’s review all of your debt. It’s very simple. you have a few choices when it comes to canceling credit cards. You could pay the smallest balance first then move to the next one. The way to do this is pay the minimum on the other cards and pay as much as possible on the smallest card. This would be a psychological win and show you it’s possible to pay off the debt. Sometimes we’re overwhelmed and we could feel like we’re stuck in hole but all we need is some motivation. What’s better motivation than canceling 1 entire credit card. You can also pay an extra $50 a month on every card and play the waiting game. Paying an extra $50-$100 will reduce the term, many times by years and you’ll save thousands of dollars in interest. That’s if you have 3-4 credit cards.

If you have 1-2 credit card with a smaller balance, awesome! Getting rid of those credits should be easier. Make sure to call the credit companies and negotiate your interest rates especially if you’re always on time. You can also have them wave any fees if they refuse, tell them you want to speak to a manager.

The good old, “I’ll take my business elsewhere if you don’t wave these fees.” never fails.

The point is to plug any leaks and redirect the flow of money to where it has to go. Life is not easy but it is simple and so is money. It’s complex when you have 10,000 people telling you what to do with your money and they all contradict themselves with things like buy crypto, gold ,save or buy a home. Keep it simple, the important thing is to act. Avoid analysis paralysis and start here.

Stay Ahead Of The Game

Go to vanguard.com

1. Go to vanguard.com

2. Open a Traditional Roth IRA Account

3. Contribute Money (It could be overtime)

4. Type in the year you plan on retiring (on the search bar)

5. Buy in on Target Date Funds (usually require about $1000 to buy in)

6. Set up automatic bank transfer to this account

7. Live Life worry free

Simplify your life.

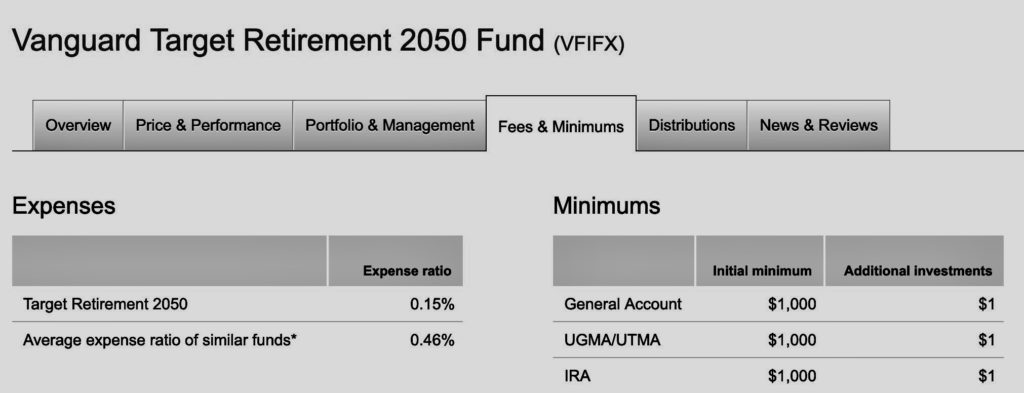

Think of this as a savings account and let the your money cook over time. The reason why I recommend opening up a Vanguard account is because of the low fees and a very user friendly interface. This is an ethical company that has been around forever. Now let’s simplify your life, all you have to do is set up this account and contribute as much money as you can, and that’s it. The thing about low risk accounts like index funds or target date funds is the smaller rewards. But having something is better than nothing.

You might ask what’s a target date fund and why should I put my money there? Let’s say you’re 40 years old and plan on retiring at 65 years old that means you’d join the 2045 or 2050 account. Target date funds are designed to allocate your assets (money) according to the date you plan on retiring. So it basically builds a diversified portfolio that will automatically rebalance itself all on its own overtime. Which is perfect for anyone who doesn’t understand investing or have time to look up what’s the best next stock. Do your own research and find what fits your budget best. However most people who buy stocks don’t match the market because they buy and sell to soon and lose money in trading fees and taxes.

This is low risk and low maintenance and serves it’s purpose. I did the research so you didn’t have to. If you’re like me and want to make money but don’t have the time to constantly look at the screen to pick stocks or feel illiterate in terms of finance, Set this up and use your energy to focus on other areas of life.

I bet this isn’t how you pictured investing lol. If picking stocks is something you want try, be my guest but consider it a hobby and not a way to set money aside for retirement. Don’t over complicate yourself, set yourself up for success. Target date funds do all the heavy lifting. So if you don’t want to think about investments or having to rebalance your portfolio, this is the way to go. Anyone can do it, you don’t have to be a millionaire to invest nor do you need to pay a professional advisor to give you tips.

You can get this done within 2 hours. you have no excuse.

To learn more pick up a copy of “I will teach you to be rich” by Remit Sethi

Recent Comments